Margin information

Review our margin requirements and other information related to margin trading with Quantum Bank

For retail margin rates, please see margin information for retail clients.

Initial and Maintenance Margin

Initial margin and maintenance margin are designed to protect you against adverse market conditions, by creating a buffer between your trading capacity and margin close-out level.

- Initial margin: a pre-trade margin check on order placement, i.e. on opening a new position there must be sufficient margin collateral available on account to meet the initial margin requirement for the entire margin portfolio.

- Maintenance margin: a continuous margin check, i.e. the minimum amount of cash or approved margin collateral that must be maintained on account to hold an open position(s). Maintenance margin is used to calculate the margin utilisation, and a close-out will occur as soon as you do not meet the maintenance margin requirement.

Read more about Initial and Maintenance margin here.

Margin requirements: FX

For professional clients, lower margin rates apply. Please log in and check the platform for more details.

Tiered Margin Methodology

Margin requirements differ by currency pair and depend on the exposure in the currency pair. Margin requirements may be subject to regulatory mandated minimums and may be subject to change according to the underlying liquidity and volatility of the currency pair. For this reason, the most liquid currency pairs (the majors) in most cases require a lower margin requirement.

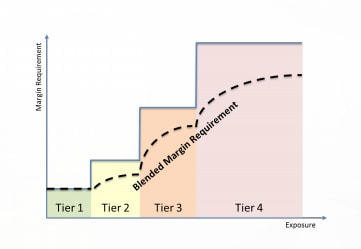

Quantum Bank offers tiered margin methodology as a mechanism to manage political and economic events that may lead to the market becoming volatile and changing rapidly. With tiered margin, the average margin requirement (‘Blended Margin Requirement’) increases with the level of exposure. The opposite is also true; as the level of exposure decreases the margin requirement also decreases. This concept is illustrated below:

The different levels of exposure (or tiers) are defined as an absolute number of U.S. Dollars (USD) across all currency pairs. Each currency pair has a specific margin requirement in each tier.

Please note that margin requirements may be changed without prior notice. Quantum Bank reserves the right to increase margin requirements for large position sizes, including client portfolios considered to be of high risk.

How do I recategorize as a professional?

By default retail margins will apply. As a client regulated under ESMA (European Securities and Markets Authority) and based on a specific set of eligibility criteria you can apply to reclassify as an elective professional. Margin rates for elective professional clients differ from retail clients. You can find more information about margin rates and eligibility criteria here.

Collateral rates for margin trading

(Professional clients only)

Collateral rates for stocks and ETFs

Collateral rates for stocks and ETFs

Quantum Bank allows a percentage of the investment in certain Stocks and ETFs to be used as collateral for margin trading activities. The collateral value of a stock or ETF position depends on the rating of the individual stocks or ETFs – please see conversion table below.

Example: 75% of the value of a position in a Stock or ETF with Rating 1 can be used as collateral (instead of cash) to trade margin products such as Forex, CFDs, Futures and Options. Please note that Quantum Bank reserves the right to decrease or remove the use of Stock or ETF investment as collateral for large position sizes, or stock portfolios considered to be of very high risk.

To find the rating and collateral value, search for a specific instrument in our platform preview and open its product overview. Select the info button (i) on the top right, then go to the Instrument tab.

Collateral rates for bonds

Quantum Bank allows Professional clients to use a percentage of certain bond investments as collateral for margin trading activities.

The collateral value of a bond position depends on the rating of the individual bond, as outlined below:

| Rating definition* | Collateral percentage |

|---|---|

| Highest Rating (AAA) | 95% |

| Very High Quality (AA) | 90% |

| High Quality (A) | 80% |

* as rated internally by Quantum Bank

Example: 80% of the market value of a bond position with an A rating can be used as collateral (instead of cash) to trade margin products such as Forex, CFDs or Futures and Options.

Please note that Quantum Bank reserves the right to decrease or remove the use of bond positions as collateral.

See all our prices

Stocks

Commissions from

$1

on US stocks

Access 23,000+ stocks across core and emerging markets on 50 exchanges worldwide.

ETFs

Commissions from

$1

on US listed ETFs

Access more than 7,400 exchange traded funds from 30 + exchanges.

Bonds

Commissions from

0.05%

on US stocks

Access more than 5,200 government and corporate bonds available across exchanges and OTC markets.

Mutual funds

Commission and platform fees at

$0

We’ve made it easy and affordable to invest in mutual funds from leading providers.